DOGE Price Prediction: Technical Breakout and Institutional Momentum Signal Potential Rally to $0.45

#DOGE

- DOGE trading above 20-day MA indicates underlying bullish momentum

- Institutional ETF developments and whale accumulation provide fundamental support

- Technical analysis suggests potential upside toward $0.45 resistance level

DOGE Price Prediction

Technical Analysis: DOGE Shows Bullish Momentum Above Key Moving Average

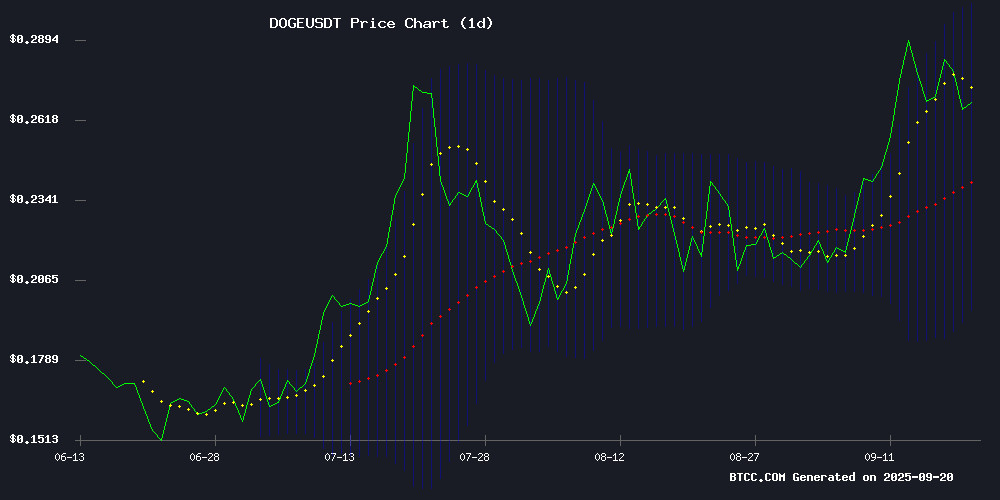

DOGE is currently trading at $0.266, positioned above its 20-day moving average of $0.249, indicating underlying strength. The MACD remains negative but shows improving momentum with the histogram at -0.0098, suggesting potential trend reversal. Bollinger Bands indicate the price is trading closer to the middle band, with room to test the upper resistance at $0.302. According to BTCC financial analyst James, 'The technical setup suggests consolidation with bullish bias, with a break above $0.30 potentially triggering further upside toward $0.45.'

Market Sentiment: Institutional Interest and Whale Accumulation Support Bullish Outlook

Recent news flow surrounding Dogecoin reflects growing institutional interest and positive market sentiment. Grayscale's ETF proposal advancement, combined with significant whale accumulation of 910 million DOGE in four days, indicates strong underlying demand. Analyst projections of a potential move to $0.45 align with the technical outlook. BTCC financial analyst James notes, 'The combination of institutional ETF developments and substantial whale activity creates a favorable backdrop for DOGE's medium-term prospects, though weekend trading may remain muted in the near term.'

Factors Influencing DOGE's Price

Dogecoin Price Faces Muted Weekend but Eyes Recovery in June

Dogecoin's price action remains subdued as the weekend unfolds, with little volatility expected in the short term. CoinCodex's machine learning algorithm predicts a marginal decline, keeping Doge above $0.26—a drop of less than 2% from current levels. The meme coin appears to be consolidating, with traders awaiting clearer signals.

June could bring a turnaround. The same algorithm forecasts a potential climb to $0.34 later this month, suggesting accumulation at current levels. Longer-term projections indicate DOGE may stabilize above $0.30 if bullish momentum returns, though weekend traders shouldn't expect fireworks.

Grayscale Advances Dogecoin ETF Proposal Amid Competitive ETF Launches

Grayscale Investments has amended its filing for a Dogecoin ETF, signaling intensified efforts to launch the product under the ticker GDOG on NYSE Arca. Coinbase is slated to serve as custodian and prime broker, with the trust designed to hold DOGE as its underlying asset. The move follows regulatory discussions about integrating meme coins into the SEC's digital asset framework.

Competitive pressure is mounting as Rex Shares' Osprey dogecoin ETF (DOJE) saw $17 million in volume on its debut day, ranking among 2025's top ETF launches. Bloomberg analyst Eric Balchunas noted $6 million traded within the first hour alone, demonstrating robust demand for speculative assets through regulated vehicles.

Grayscale's simultaneous rollout of the CoinDesk crypto 5 ETF (GDLC) underscores institutional momentum in crypto markets. The filing revision reflects a strategic pivot to capture growing investor appetite for meme coin exposure, particularly after rivals proved the viability of such products.

Dogecoin Rally Sparks $1 Speculation as Institutional Demand Grows

Dogecoin's price surged 13.9% in 24 hours and 38% weekly to $0.2963, its highest level since January. The meme coin now tests the critical $0.30 resistance level, with traders anticipating a potential parabolic move.

Institutional accumulation appears to be driving momentum. CleanCore Solutions disclosed a 500 million DOGE position, planning to double its holdings to one billion tokens within 30 days—a nearly $300 million bet at current prices. This follows confirmation of ETF liquidity and nine-figure acquisitions by institutional wallets.

The rally has outpaced major altcoins including Solana, XRP, and Ethereum, cementing DOGE's position as the dominant meme coin this cycle. Analysts now view the $1 target as increasingly plausible rather than speculative.

Dogecoin Ready To Bark Again? Analyst Sees Path To $0.45

Dogecoin could rally to $0.36 or even $0.45 if it breaks a key resistance level, according to analyst Ali Martinez. The meme coin is retesting the upper boundary of a parallel channel, a technical pattern that has confined its price movement for months.

Parallel channels, defined by two parallel trendlines, often signal consolidation. Dogecoin's current channel is horizontal, with the upper line acting as resistance and the lower as support. A breakout above resistance could trigger significant upside momentum.

Martinez's chart shows Dogecoin recently retested the upper trendline but faced rejection. The asset's ability to overcome this barrier will determine whether it can achieve the analyst's bullish targets.

Dogecoin Whales Accumulate 910 Million DOGE in Four Days Amid Price Rally

Dogecoin whales have aggressively increased their holdings this week, with wallets holding between 100 million and 1 billion DOGE adding approximately 910 million tokens to their balances. Santiment data reveals these large investors boosted their combined holdings from 26.48 billion DOGE on September 15 to 27.39 billion DOGE by September 19—a $250 million accumulation at current prices.

The buying spree coincided with DOGE's price surge from $0.26 to above $0.28, suggesting whale activity fueled the rally. Reduced market liquidity and growing confidence in the meme coin often follow such accumulations, typically prompting retail traders to follow suit.

Dogecoin Whales Accumulate Amid Price Resistance, Hinting at Potential Bull Cycle

Dogecoin's recent price action reveals a tug-of-war between accumulation and resistance. Despite a 1.65% drop to $0.2756, on-chain data shows whales holding 1-10 million DOGE have scooped up 158 million coins. Short-term holders are mirroring historical accumulation patterns that preceded past bull runs.

Key levels loom large: $0.2698 support and $0.2914 resistance. The market remains dominated by over-leveraged short positions, yet the whale activity suggests institutional players are positioning for a breakout. 'When STHs accumulate like this, the market usually follows with momentum,' observes Alphractal's on-chain dashboard.

Trading volume remains subdued during this correction—a potential calm before the storm. The memecoin's ability to hold above $0.26 could determine whether this becomes a springboard or a stumbling block for DOGE's next major move.

Is DOGE a good investment?

Based on current technical indicators and market developments, DOGE presents a compelling investment opportunity for risk-tolerant investors. The price trading above the 20-day MA, combined with institutional ETF progress and substantial whale accumulation, suggests growing confidence. However, investors should consider the following factors:

| Factor | Current Status | Investment Implication |

|---|---|---|

| Price vs 20-day MA | $0.266 > $0.249 | Bullish signal |

| MACD Momentum | Improving histogram | Potential trend reversal |

| Whale Activity | 910M DOGE accumulated | Strong institutional interest |

| ETF Developments | Grayscale proposal advancing | Long-term positive catalyst |

While short-term volatility may persist, the combination of technical strength and fundamental developments supports a positive medium-term outlook.